NTN Registration in Pakistan – A Step-by-Step Guide

NTN (National Tax Number) registration is essential for individuals in Pakistan who want to file their income tax. Whether you are a salaried person, freelancer, or business owner, you must register with the Federal Board of Revenue (FBR) to comply with tax laws.

Click here to Get Your NTN for Free

Why Do You Need NTN Registration?

- To file income tax returns.

- To become a filer and avail tax benefits.

- To open a business bank account.

- To register a business with government authorities.

Documents Required for NTN Registration

- CNIC (Computerized National Identity Card)

- Proof of Business (if applicable)

- Electricity or Gas Bill (for business NTN)

- Active Mobile Number & Email (for OTP verification)

Step-by-Step Process for NTN Registration

Step 1: Visit the FBR Iris Portal

Go to the FBR Iris Portal by clicking this link.

Step 2: Register as a New User

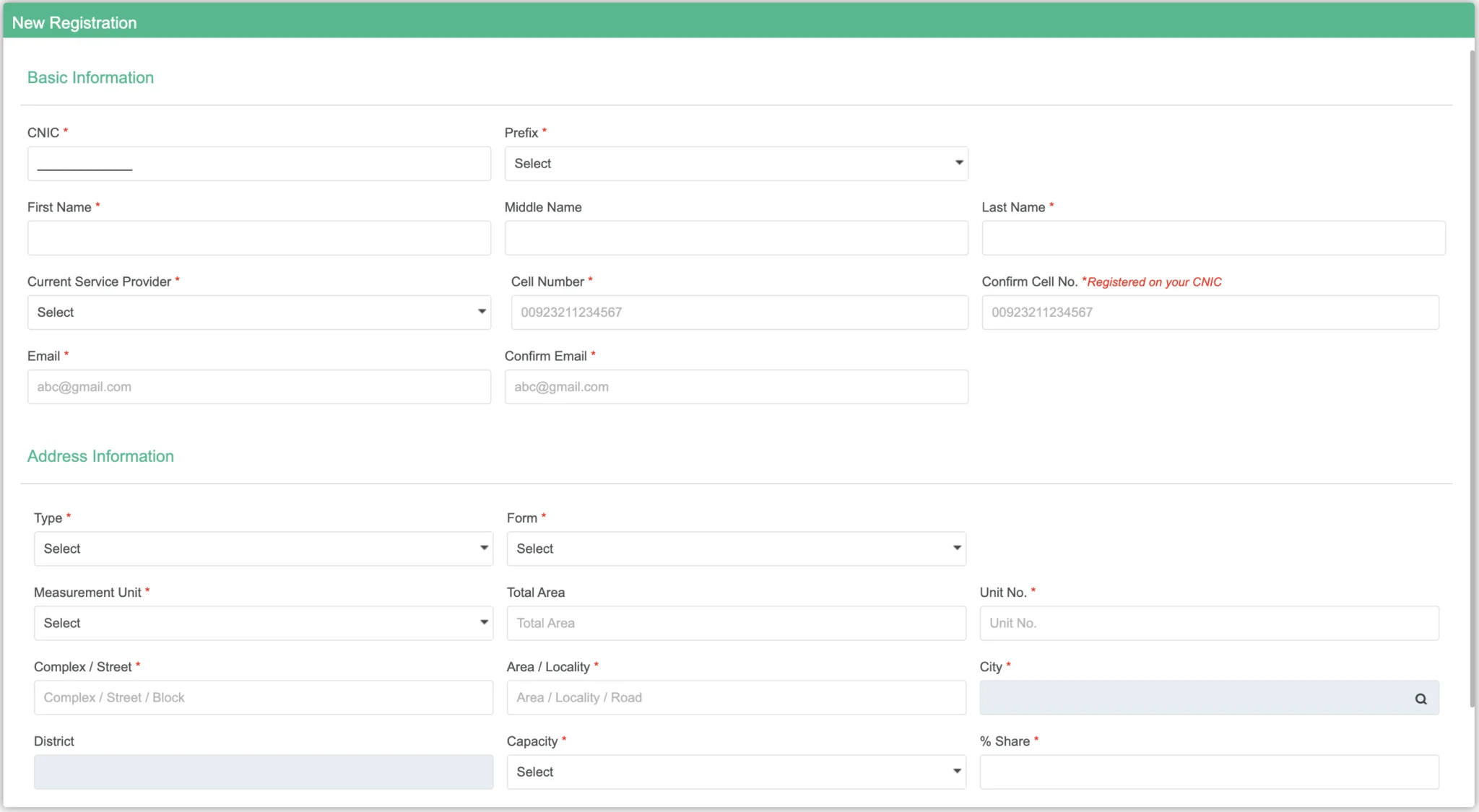

Click on “Registration for Unregistered Person” and enter your CNIC, name, email, and phone number address and other details as requested in the form.

Step 3: Receive Login Credentials

FBR will send OTP via SMS and email, add them in the portal and FBR will send your password to your mobile and email.

How to Check NTN Registration Status?

You can verify your NTN by visiting FBR’s verification portal and entering your CNIC number.

Benefits of Becoming a Tax Filer

- Lower tax deductions on bank transactions and property purchases.

- Eligibility for government tenders and business loans.

- Legal protection and compliance with FBR.

Need Help with NTN Registration?

If you need assistance with your NTN registration and income tax filing, contact us today for expert tax consultancy.